Practical Solutions for Small and Mid-sized Companies Facing Cash Flow Issues

In the world of business, managing cash flow is crucial. Cash flow signifies the rate at which a company is recouping its expenses, providing salaries, and generating profits. It's one of the most significant indications of a company's financial health and the barometer for its long-term success. However, small to mid-sized companies often have to face various financial hurdles when it comes to cash flow management. Stringent market conditions, vendor payments, lease payments, and employee benefits can all disrupt your cash flow and cause problems. As a CEO or entrepreneur, understanding your company's finance can be a daunting and intimidating task. But, rest assured, with practiced financial management and the right guidance, these obstacles can easily be overcome.

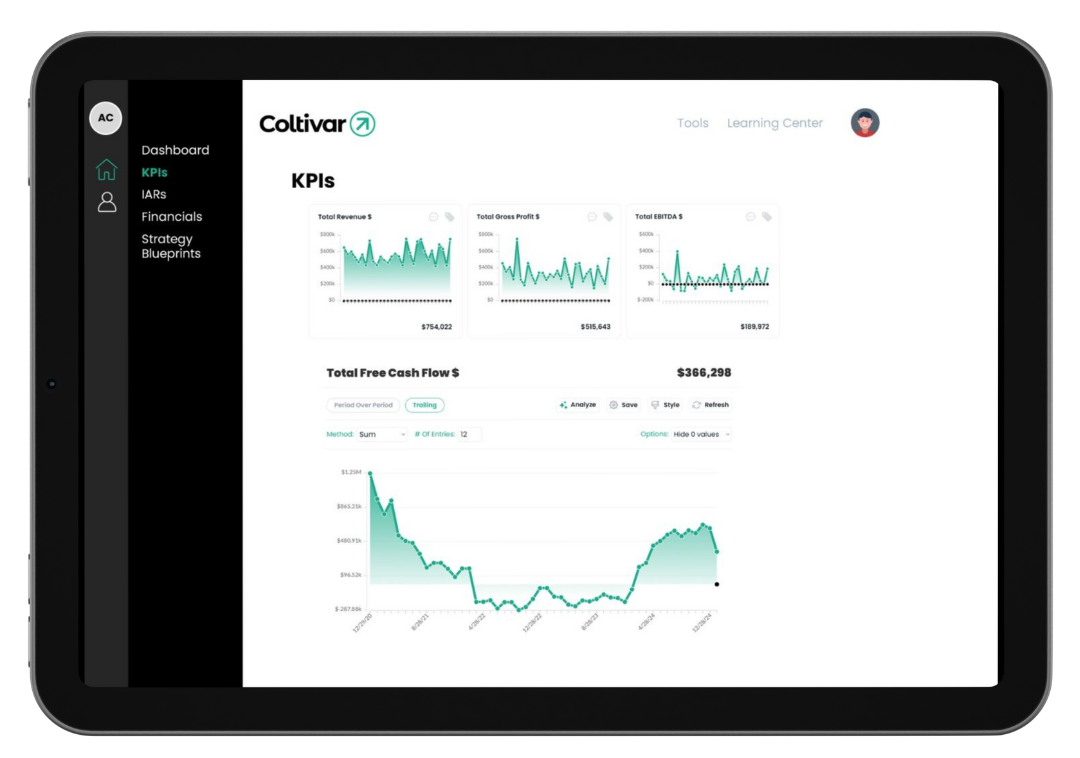

1. Analyze and Track your Financials: The first step in managing your company's finances is to analyze and track them. Regularly reviewing financial statements can help you identify areas that need improvement or identify financial trends. It also helps to understand if your company's cash flow is positive or negative. Tracking cash flow enables you to identify the source and determine the amount of cash that your business will receive or spend, giving you a better understanding of your company's liquidity. This information will help you make essential decisions about payments to vendors, purchase decisions, and employee salaries.

2. Build Cash Reserves: Cash reserves represent a buffer of money that can be used in emergencies, such as unexpected expenses, tax payments, or sudden fluctuations in income. Consistently allocating cash into reserves can help you manage unexpected financial challenges without having to cut costs or take out emergency loans to keep the business running. It's important to have a plan for how you will build and maintain your reserves, such as allocating a fixed percentage of your profits towards it.

3. Improve your Payment and Collection Process: One of the most common issues that small businesses face when it comes to managing cash flow is the payment and collection process. Inefficient payment processes that delay payment collection or lengthy invoicing procedures can severely impact your cash flow. You can improve this process by streamlining your invoicing procedures, accepting electronic payments, and reducing payment terms. Additionally, establishing good relationships and consistent communication with vendors can expedite the collections process, ensuring that the cash flow remains steady.

4. Implement Strategic Plans to Improve Profitability: Cash flow is directly correlated with profitability; therefore, improving your company's profitability can lead to better cash flows. Begin by determining which products or services are driving most of your company's revenue and focus on promoting these while reducing spending on those with lower margins. Introducing new revenue streams or partnerships can also help to expand profit centers. Finally, reducing overall expenses, renegotiating vendor contracts, and conducting regular cost analyses will help improve the bottom line and increase profitability.

5. Partner with Coltivar for Financial Guidance: Beyond the practical actions you can take on your own to manage your company's cash flow, Coltivar offers strategic guidance to take your company to the next level. Coltivar provides comprehensive financial advisory services that combine analysis, planning, and the implementation of strategic action. Our team of experienced financial advisors can help you create a focused, comprehensive financial strategy tailored to your company's needs. We value our client relationships, and our primary goal is to help you succeed.

Managing cash flow for small to mid-sized businesses presents unique challenges, but they can be overcome with the right strategies and guidance. By taking practical steps such as analyzing and tracking finances, building cash reserves, improving payment and collection processes, and implementing strategic plans, you can ensure long-term financial health for your company. If you want to take your company's cash flow management to the next level, Coltivar's team of financial advisors is here to support you every step of the way. Don't hesitate to contact us today and let's get started on your financial journey!